We look out for our members. You can add these optional protections to help you in times of distress.

The Details

Loan Payment Protection

(a voluntary loan program that will cancel or reduce repayment of your loan debt)

As a borrower or co-borrower on a consumer loan, you are protected when life hits you with unexpected events (like involuntary unemployment, a disabling injury, or even death)

- Protects up to $100,000.00 of your loan balance

- Easy enrollment at the time you obtain a loan with us

- No medical exam required

- Available to most loan members who are actively working 25 hours a week for income at the time they enroll for disability or involuntary unemployment

- Monthly payment plan — cost can be added to your monthly payment each month

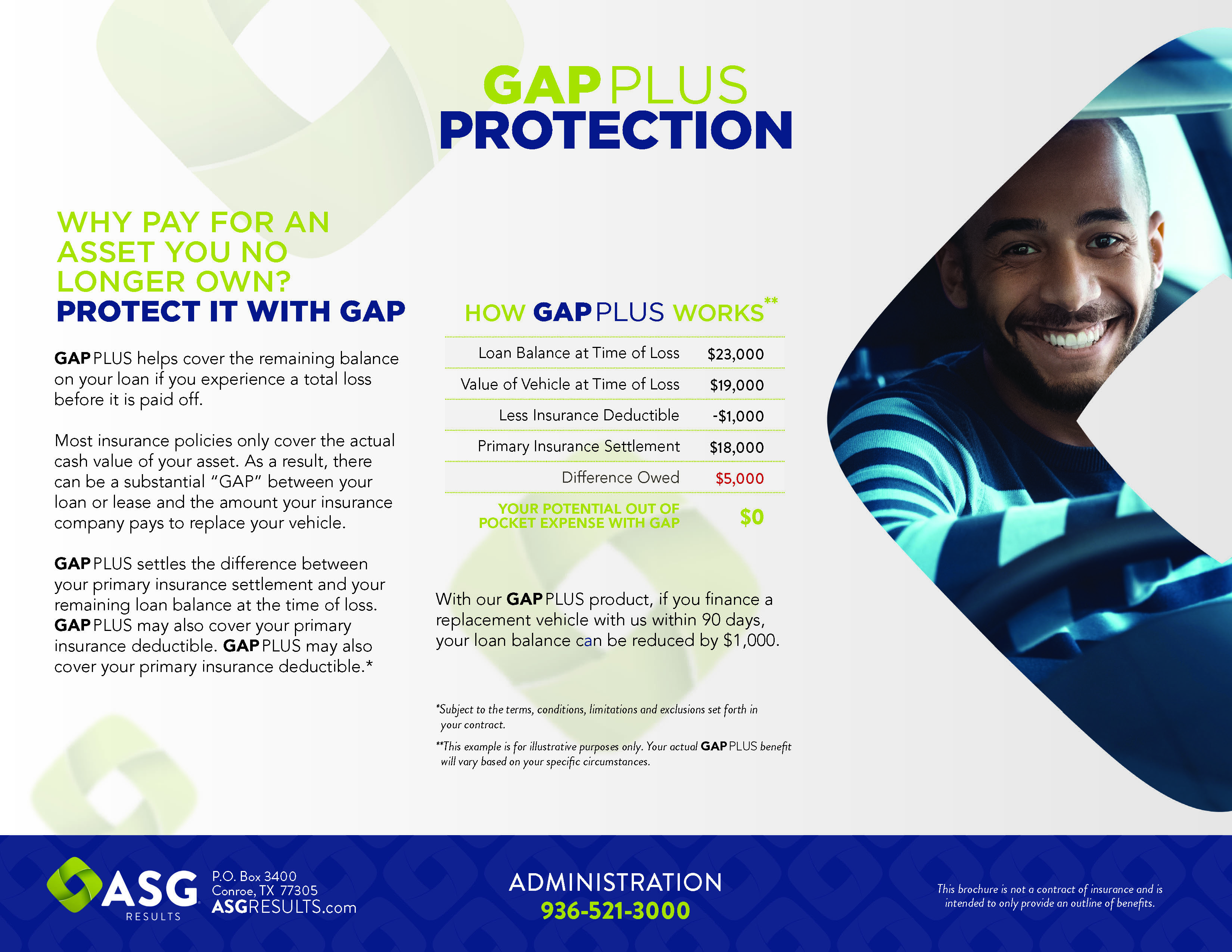

GAP PLUS (Guaranteed Asset Protection)

(a voluntary program that helps cover the remaining balance on your loan if you experience a total loss before it is paid off)

Don't be left paying for an asset you no longer own. Protect it with GAP PLUS.

- May also cover your primary insurance deductible*

- Easy enrollment at the time you obtain a loan with us

- Monthly payment plan — cost can be added to your monthly payment each month

*Subject to the terms, conditions, limitations and exclusions set forth in your contract

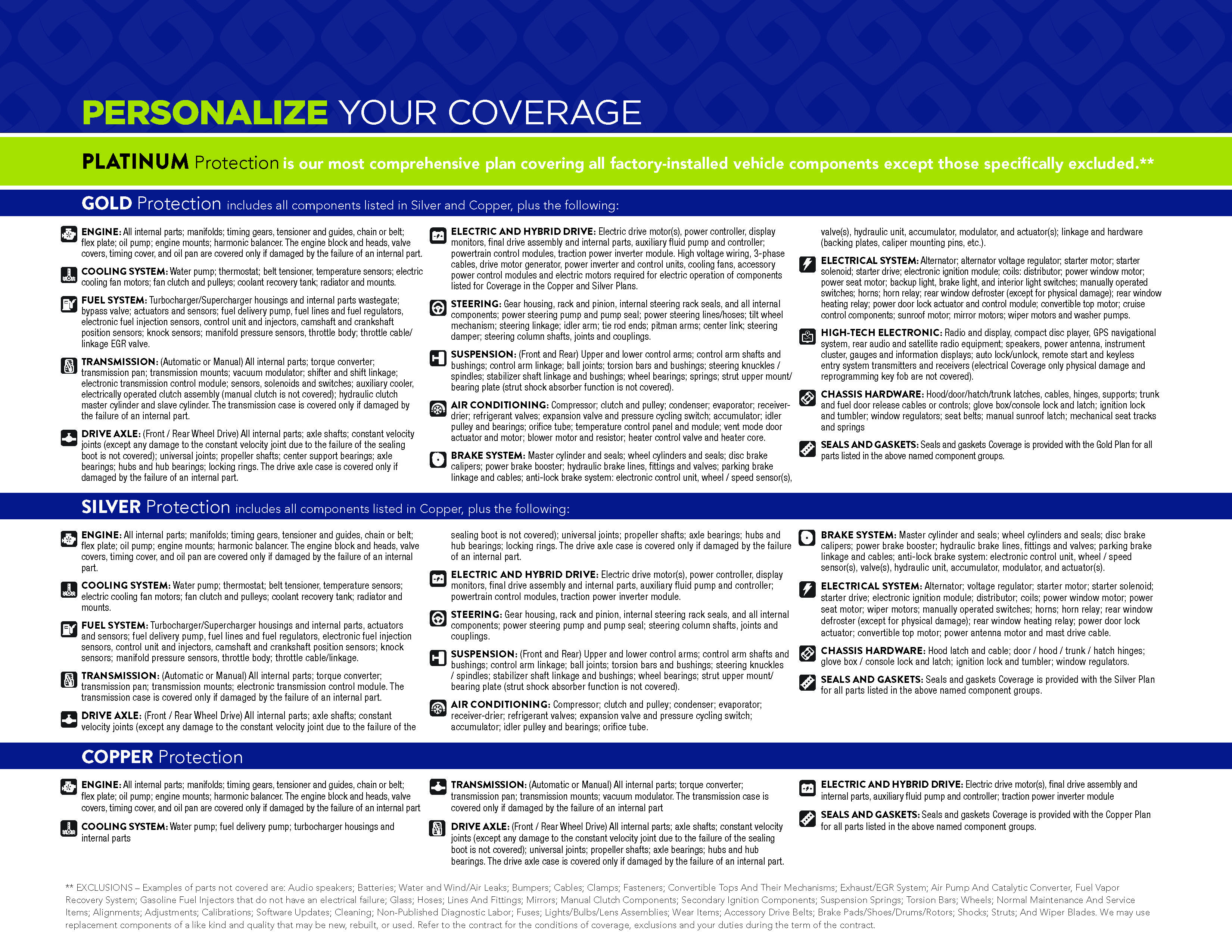

Mechanical Breakdown Protection

(a voluntary program providing the peace of mind knowing your vehicle is protected even AFTER the factory warranty has expired)

Avoid expensive repairs by protecting your vehicle, should a mechanical breakdown occur.

- 4 levels of protection to choose from. Each of them include the below benefits:

- Roadside Assistance

- Rental Vehicle

- Tire Road Hazard

- Trip Interruption

- Easy enrollment at the time you obtain a loan with us

- Monthly payment plan — cost can be added to your monthly payment each month